Apple's iPhone and The Future of Nokia

Source

Sramana Mitra writes why she thinks Nokia is going to continue to dominate the low-end mobile market, but might have to struggle to stay in the high-end market.

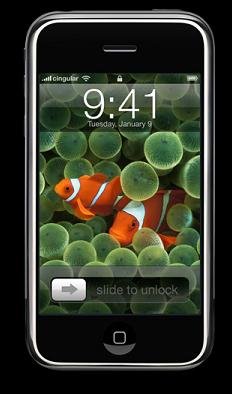

Sramana Mitra submits: We have been discussing the impact of Apple's (AAPL) iPhone on the rest of the cellular handset and laptop ecosystem. Frank Levinson wrote an important piece when the iPhone was first announced, which you should read for context.We have said that Research in Motion's (RIM) target market (Prosumer, SmartPhone with Integrated Messaging) is very different from the iPhone's (Consumer, SmartPhone with Media Player focus). Nokia (NOK), however, has a lot more overlap with the iPhone’s target audience.

iPhone’s Innovations:

1. The use of OSX – this choice empowers the device to be able to run Safari, mail and widgets. It continues to unify the Apple product line, not fragment it.

2. The use of a new consumer user interface [UI] and the deletion of so many buttons and choices (this was what we did about 16 years ago with Windows and 23 years ago with the first Mac and now we are doing it again).

3. The realization that Moore’s law scaling of silicon is continuing and this makes the possibilities of integration infinite.Nokia’s Strength: Hardware/Silicon Integration.

Nokia knows how to do this well, by itself, and through its partnerships with Semiconductor vendors. The key technology in question so far has been System-in-Package (SiP). More on the semiconductor side later.

Nokia’s Weakness: The Symbian OS.

In 2006, Symbian was estimated to have a 73% share of the smartphone OS market, yet ABI Research forecasts that it will fall to 46% by 2012, due to strong competition coming most notably from Linux, but also from Windows Mobile. At the moment, Microsoft (MSFT), Palm (PALM) and RIM each have very low market share in worldwide Smartphone OS. The MAC OS competition has not even started yet!

According to ABI, Nokia has maintained its leadership position with a 56.4% share of the 70.9 million units shipped in 2006. Nokia sold 40 million smartphones in 2006, compared to 28.5 million in 2005. Motorola also had a strong 2006 and occupied the second position with 8.5% market share, driven by the success of its Linux-based devices in China, most notably the MING. The Prosumer segment of that market should remain largely unaffected by the entry of the iPhone. The Consumer Smartphone, however, WILL get affected, and this is likely to impact Nokia’s market share, especially in the high end of the market.

Unresolved question: Will the market accept the two-hand iPhone user experience, or stay with the one-hand Palm-Blackberry-Nokia interface?

Resolved question: Apple will win the design challenge, still a key determining factor in which product consumers would choose to buy. The others will need to win on other criterion, besides design.

Emerging Markets: Nokia’s Strength

Nokia has many other strengths. Foremost is their absolute dominance of the low-end market. It dominates India, the fastest growing Mobile market in the world, with 79% market share. iPhone is not even an issue in this market because of its astronomical price-point.

Overall, it seems to me that only a very small sliver of Nokia’s business will get impacted by the iPhone in the foreseeable future. However, as Nokia and other handset makers struggle with the atrociously low margin business they’re in, they will all try to move up the value chain and get more of the high-end, higher margin products into their mix. This is where the iPhone is a threat to Nokia’s future, because that small sliver of the market is a rather critical piece of Nokia’s equation

No comments:

Post a Comment