iPhone's launch harkens more growth for Apple

More growth for Apple, the iPhone route. Can the iPhone do an 'Ipod' to Apple's Growth and profit margins ?

Source

LOS ANGELES — Today, the iPod; tomorrow, the iPhone.

Investors Thursday cheered Apple's record second-quarter results, which showed major sales growth for its iPod digital music device and Mac computers. But Apple's best days are ahead, tech analysts say.

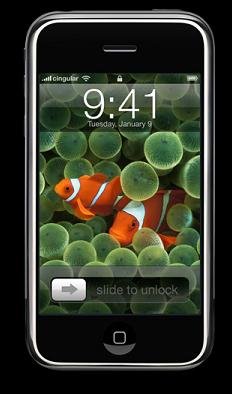

Apple is putting most of its energies into the June release of the iPhone, a combination iPod/Internet browser and cell phone that will sell for $499 and $599. Apple CEO Steve Jobs has projected sales of 10 million iPhones in its first year. At an average retail price of $500, that would generate $5 billion in additional sales. “The iPhone has the potential to be even bigger than the iPod,” says Gene Munster, an analyst with Piper Jaffray. “The cell phone market is gigantic.”

ADVERTISEMENT

Charles Wolf, president of investment consultant Wolf Insights, says Apple will likely follow its iPod pricing strategy — starting with a high retail price, and lowering it as costs decrease. “Once the price comes down, Apple could get to a 5 percent market share of phones, good for 75 to 100 million units a year,” Wolf says.

Mac sales have doubled from five years ago, when the iPod was introduced. Wolf believes the iPhone will have a similar “halo effect.”

“Now you have another device besides the iPod that will get people interested in Macs,” says Shaw Wu, an analyst at American Technology Research. “The iPhone is basically a portable Mac.”

Apple's computer business is growing. But its shipments of 1.5 million computers in the first quarter is “a drop in the bucket” compared with overall computer shipments, Wolf says.

According to researcher Gartner, some 62.7 million PCs were shipped worldwide in the first quarter, with Apple registering a 5 percent market share in the United States.

No. 1 manufacturer Hewlett-Packard shipped 11 million PCs.

Munster thinks the success of the iPhone could help Apple eventually more than triple its computer shipments, to 5 million a quarter.

But he says that at his most optimistic, he can't imagine Apple's computer market share rising to above 15 percent in the United States. “Apple doesn't play in the business and government markets, where the really huge sales are,” he says.

Investors don't seem concerned about an Apple options-backdating scandal that has made headlines, Wu says. “It's behind us.”

On Tuesday, the Securities and Exchange Commission filed civil charges against two former Apple officers. One, former CFO Fred Anderson, claimed Jobs knew more about the backdating than Jobs or Apple has acknowledged. The SEC settled with Anderson, who agreed to pay a $3.5 million fine but admitted no wrongdoing. On Wednesday, Apple's board said it has “complete confidence” in Jobs.

Apple stock closed up 3.7 percent Thursday at $98.84, a record, and briefly topped $100 a share for the first time.

No comments:

Post a Comment