Apple's iPhone and the Future of Research in Motion

Sramana Mitra submits: Frank Levinson wrote an important piece when Apple's (AAPL) iPhone was first announced. As we approach the launch of the iPhone, I would like to review what is going on in the rest of the ecosystem, and how the players are preparing.Let’s start with Research in Motion (RIMM). The company has recently announced results, and after a strong 6 month run up, the stock dropped sharply because results met, but did not exceed expectations. [52-wk range: $67.95 - $171.46]

So what are the expectations around RIM vis a vis the iPhone?

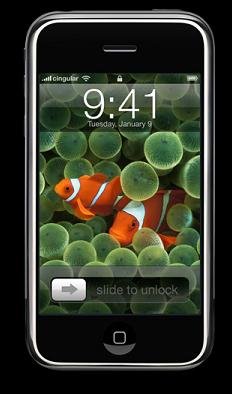

The iPhone, for the next two years I believe, is going to be a classical Consumer product and build upon its iPod legacy, focusing squarely on the media player capabilities (Let’s call this the Consumer Smartphone).

RIM, on the other hand, is a classical Prosumer/Enterprise product, where the competitor is less Apple, more Palm (PALM), Motorola (MOT) and Nokia (NOK). This means, that RIM and Apple are by and large not competing for the same customer base. RIM, in its segment (Prosumer SmartPhone), is the second most popular vendor, behind Nokia, having overtaken Palm.

Apple’s innovations: 3 things –

1. The use of OSX – this choice empowers the device to be able to run Safari, mail and widgets. It continues to unify the Apple product line, not fragment it.

2. The use of a new consumer user interface [UI] and the deletion of so many buttons and choices (this was what we did about 16 years ago with Windows and 23 years ago with the first Mac and now we are doing it again).

3. The realization that Moore’s law scaling of silicon is continuing and this makes the possibilities of integration infinite.These three innovations offer up the opportunity for Apple to become the laptop replacement.

The longer term story may, therefore, become very different, as Apple expands out of the Consumer segment, and uses its “Ultimate Convergence Device” positioning to go after small laptops, NOT just the SmartPhones. This would require them to address issues like an enterprise class messaging system, the core differentiating function for the RIM Blackberry lines. However, that is still probably a few years out.

While on the hardware side, Moore’s Law is driving all the mobile handset vendors towards hyper-integration, the OS and application layer capabilities on each system is dramatically different. MAC OS certainly has the most power. But it doesn’t work very well with the rest of the enterprise software ecosystem. Not yet, anyway. This will be the reason for Apple’s limited penetration in the Prosumer segment.

There is one more unknown in this equation yet. Apple’s bet on a touchscreen ONLY User Interface requires a 2-hand usage model. Blackberry is a one-hand device. How will the market respond to the change?

Finally, pricing. Apple’s pricing strategy positions the iPhone against the laptop, not the Smartphones. I don’t think all the Smartphone customers will abandon their laptops quite so rapidly, even though, they would eventually very much like to do so.

Eventually, RIM’s competition is not only going to be Apple and the iPhone. It will also be the laptop vendors, and that is when the game will start to get really exciting. And this is also why, I don’t consider RIM a long term Hold. It could, however, be an excellent acquisition target for Dell (DELL), especially, who desperately needs a convergence device strategy, and needs to buy either RIM or Palm.

Meanwhile, Apple continues to keep the industry on its toes, and every few months, sends everyone back to their drawing boards.

No comments:

Post a Comment